Gross and Net GST revenue collections for the month of Dec, 2025 is ₹ 1,74,550 crore and ₹1,45,570 crore

Stevedoring, Transportation, Storage, Bagging, Stuffing in respect of Goods temporarily Imported before Export amounts to Export of Service w.e.f. 01 February, 2019

The members of Gujarat Authority for Advance Ruling, Goods and Services Tax ruled that services such as stevedoring, transportation, storage, bagging, stuffing and again transportation of the goods (which have been temporarily imported into India) rendered by the applicant shall be considered as ‘export of service’ and shall be eligible for ‘Zero Rated Supply‘ w.e.f. 01.02.2019.

The details of the Advance Ruling are as under:

Brief Facts

- The applicant, a service provider operating in a port, is engaged in handling bulk imported fertiliser on behalf of Indian fertiliser companies. They discharge bulk fertiliser from the vessels, pack it into bags and then make dispatches by Rail, Road and Water.

- They, as the service providers, did stevedoring, transportation, storage, bagging, stuffing and again transportation of the goods which were temporarily imported.

- A foreign supplier sent bulk fertiliser for job work in custom bonded godowns.

- The cargo directly went from vessel to custom bonded warehouses and these goods never crossed the customs barrier and mixed-up with the indigenous goods.

- These goods were temporarily imported to India for export purpose and stored in customs bonded warehouses and exported from there to outside India.

Questions seeking Advance Ruling

- Whether above described services (in brief facts) considered to be Export of Service or not?

- If Yes, then we are eligible for Zero Rated Supply under Section 16 of the IGST Act, 2017?

Discussions and Findings

- As per Section 2(14)(d) of the IGST Act, 2017, the location of the recipient of services in the case under discussion is the usual place of residence of the recipient i.e. outside India.

- Section 2(6) of the IGST Act, 2017 stipulates five conditions for services to be considered as ‘export of services’.

“2(6) “export of services” means the supply of any service when,–

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;”

- The conditions (i), (ii), (iv) and (v) were satisfied but condition (iv) required further discussion.

- Section 13(3) of the IGST Act, 2017 provides that the place of supply for services such as the services under discussion shall be the location where the services are performed. However, the second proviso to the mentioned section provides conditions for services to be excluded from Section 13(3).

- The second proviso, prior to 01 February 2019, excluded the services supplied in respect of goods which are temporarily imported into India for repairs and were exported after repairs without being put to any other use in India, than that which was required for such repairs.

- The services in discussion could not be considered as repairs and hence, could not be excluded from Section 13(3).

- However, Notification No.01/2019-Integrated Tax dated 29 January 2019 provided amendment in the second proviso to Section 13(3) to include ‘treatment‘ and ‘process‘ along with ‘repairs‘.

- The services provided by the applicant were in the nature of job-work and though, the services did not fall under the category of ‘treatment‘, it was considered as ‘process‘.

- Hence, w. e. f. 01 February 2019, the services in discussion were excluded from Section 13(3) and fell under the ambit of Section 13(2), which stated that the place of supply of such services shall be the location of the recipient of services i.e. outside India.

- Hence, the services shall be treated as ‘Export of Services‘ w. e. f. 01 February 2019.

- As per Section 16(1) of the IGST Act, 2017, export of goods or services or both is ‘Zero rated Supply‘.

- Hence, the services shall be treated as ‘Zero rated Supply‘ w. e. f. 01 February 2019.

Ruling

- Whether above described services (in brief facts) considered to be Export of Service or not?

The services such as stevedoring, transportation, storage, bagging, stuffing and again transportation of the goods (which have been temporarily imported into India) rendered by the applicant shall not be considered as ‘export of service’ up-to 31 January 2019, but shall be considered as ‘export of service’ w. e. f. 01 February 2019, for the reasons discussed herein-above. - If Yes, then we are eligible for Zero Rated Supply under Section 16 of the IGST Act, 2017?”

The applicant will not be eligible for ‘Zero rated supply’ under Section 16 of the IGST Act, 2017, up-to 31 January 2019 for the reasons discussed herein-above. However, they shall be eligible for ‘Zero rated supply’ as per the provisions of Section 16(1)(a) of the IGST Act, 2017 w.e.f. 01 February 2019, for the reasons discussed herein-above.

Feel free to contact us in case of any clarification required. You can download the entire ruling from here.

Relevant Provisions / References:

Section 2(6) of the IGST Act, 2017

| “export of services” means the supply of any service when,— |

Section 2(14) of the IGST Act, 2017

| “location of the recipient of services” means,— |

| (a) | where a supply is received at a place of business for which the registration has been obtained, the location of such place of business; | |

| (b) | where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment; | |

| (c) | where a supply is received at more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the receipt of the supply; and | |

| (d) | in absence of such places, the location of the usual place of residence of the recipient; |

Explanation 1 to Section 8 of the IGST Act, 2017

For the purposes of this Act, where a person has,—

| (i) | an establishment in India and any other establishment outside India; | |

| (ii) | an establishment in a State or Union territory and any other establishment outside that State or Union territory; or | |

| (iii) | an establishment in a State or Union territory and any other establishment registered within that State or Union territory, |

then such establishments shall be treated as establishments of distinct persons.

Section 13 of IGST Act, 2017

(1) The provisions of this section shall apply to determine the place of supply of services where the location of the supplier of services or the location of the recipient of services is outside India.

(2) The place of supply of services except the services specified in sub-sections (3) to (13) shall be the location of the recipient of services:

Provided that where the location of the recipient of services is not available in the ordinary course of business, the place of supply shall be the location of the supplier of services.

(3) The place of supply of the following services shall be the location where the services are actually performed, namely:—

| (a) | services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services: | |

| Provided that when such services are provided from a remote location by way of electronic means, the place of supply shall be the location where goods are situated at the time of supply of services: | ||

| Provided further that nothing contained in this clause shall apply in the case of services supplied in respect of goods which are temporarily imported into India for repairs or for any other treatment or process and are exported after such repairs or treatment or process without being put to any use in India, other than that which is required for such repairs or treatment or process; | ||

| (b) | services supplied to an individual, represented either as the recipient of services or a person acting on behalf of the recipient, which require the physical presence of the recipient or the person acting on his behalf, with the supplier for the supply of services. |

(4) The place of supply of services supplied directly in relation to an immovable property, including services supplied in this regard by experts and estate agents, supply of accommodation by a hotel, inn, guest house, club or campsite, by whatever name called, grant of rights to use immovable property, services for carrying out or co-ordination of construction work, including that of architects or interior decorators, shall be the place where the immovable property is located or intended to be located.

(5) The place of supply of services supplied by way of admission to, or organisation of a cultural, artistic, sporting, scientific, educational or entertainment event, or a celebration, conference, fair, exhibition or similar events, and of services ancillary to such admission or organisation, shall be the place where the event is actually held.

(6) Where any services referred to in sub-section (3) or sub-section (4) or sub-section (5) is supplied at more than one location, including a location in the taxable territory, its place of supply shall be the location in the taxable territory.

(7) Where the services referred to in sub-section (3) or sub-section (4) or sub-section (5) are supplied in more than one State or Union territory, the place of supply of such services shall be taken as being in each of the respective States or Union territories and the value of such supplies specific to each State or Union territory shall be in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed.

(8) The place of supply of the following services shall be the location of the supplier of services, namely:—

| (a) | services supplied by a banking company, or a financial institution, or a non-banking financial company, to account holders; | |

| (b) | intermediary services; | |

| (c) | services consisting of hiring of means of transport, including yachts but excluding aircrafts and vessels, up to a period of one month. |

Explanation.—For the purposes of this sub-section, the expression,—

| (a) | “account” means an account bearing interest to the depositor, and includes a non-resident external account and a non-resident ordinary account; | |

| (b) | “banking company” shall have the same meaning as assigned to it under clause (a) of section 45A of the Reserve Bank of India Act, 1934 (2 of 1934); | |

| (c) | “financial institution” shall have the same meaning as assigned to it in clause (c) of section 45-I of the Reserve Bank of India Act, 1934 (2 of 1934); | |

| (d) | “non-banking financial company” means,— |

| (i) | a financial institution which is a company; | |

| (ii) | a non-banking institution which is a company and which has as its principal business the receiving of deposits, under any scheme or arrangement or in any other manner, or lending in any manner; or | |

| (iii) | such other non-banking institution or class of such institutions, as the Reserve Bank of India may, with the previous approval of the Central Government and by notification in the Official Gazette, specify. |

(9) The place of supply of services of transportation of goods, other than by way of mail or courier, shall be the place of destination of such goods.

(10) The place of supply in respect of passenger transportation services shall be the place where the passenger embarks on the conveyance for a continuous journey.

(11) The place of supply of services provided on board a conveyance during the course of a passenger transport operation, including services intended to be wholly or substantially consumed while on board, shall be the first scheduled point of departure of that conveyance for the journey.

(12) The place of supply of online information and database access or retrieval services shall be the location of the recipient of services.

Explanation.—For the purposes of this sub-section, person receiving such services shall be deemed to be located in the taxable territory, if any two of the following non-contradictory conditions are satisfied, namely:—

| (a) | the location of address presented by the recipient of services through internet is in the taxable territory; | |

| (b) | the credit card or debit card or store value card or charge card or smart card or any other card by which the recipient of services settles payment has been issued in the taxable territory; | |

| (c) | the billing address of the recipient of services is in the taxable territory; | |

| (d) | the internet protocol address of the device used by the recipient of services is in the taxable territory; | |

| (e) | the bank of the recipient of services in which the account used for payment is maintained is in the taxable territory; | |

| (f) | the country code of the subscriber identity module card used by the recipient of services is of taxable territory; | |

| (g) | the location of the fixed land line through which the service is received by the recipient is in the taxable territory. |

(13) In order to prevent double taxation or non-taxation of the supply of a service, or for the uniform application of rules, the Government shall have the power to notify any description of services or circumstances in which the place of supply shall be the place of effective use and enjoyment of a service.

Section 2(68) of CGST Act, 2017

“job work” means any treatment or process undertaken by a person on goods belonging to another registered person and the expression “job worker” shall be construed accordingly;

Section 16 of IGST Act, 2017

(1) “Zero rated supply” means any of the following supplies of goods or services or both, namely:—

| (a) | export of goods or services or both; or | |

| (b) | supply of goods or services or both for authorised operations to a Special Economic Zone developer or a Special Economic Zone unit. |

(2) Subject to the provisions of sub-section (5) of section 17 of the Central Goods and Services Tax Act, credit of input tax may be availed for making zero-rated supplies, notwithstanding that such supply may be an exempt supply.

(3) A registered person making zero rated supply shall be eligible to claim refund of unutilised input tax credit on supply of goods or services or both, without payment of integrated tax, under bond or Letter of Undertaking, in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder, subject to such conditions, safeguards and procedure as may be prescribed:

Provided that the registered person making zero rated supply of goods shall, in case of non-realisation of sale proceeds, be liable to deposit the refund so received under this sub-section along with the applicable interest under section 50 of the Central Goods and Services Tax Act within thirty days after the expiry of the time limit prescribed under the Foreign Exchange Management Act, 1999 (42 of 1999) for receipt of foreign exchange remittances, in such manner as may be prescribed.

(4) The Government may, on the recommendation of the Council, and subject to such conditions, safeguards and procedures, by notification, specify—

| (i) | a class of persons who may make zero rated supply on payment of integrated tax and claim refund of the tax so paid; | |

| (ii) | a class of goods or services which may be exported on payment of integrated tax and the supplier of such goods or services may claim the refund of tax so paid. |

Research Credit: Priya Bhaiya

Why GST Exemption on COVID Vaccines may or may not be a Good Idea

Wondering how does GST exemption on Goods make it expensive? Why have the Government on India not exempted COVID-19 vaccines and supplies under GST? This article covers detailed analysis on the impact on cost of Goods exempted under GST.

Objectives and Benefits of a Cash Flow Statement

The balance sheet is a preview of entity’s financial resources and commitments at a specific place of time and the statement of profit and loss mirrors the financial performance for the period. These two parts of financial statements are based on accrual basis of accounting. However, the cash flow statement incorporates just inflows and outflows of cash and cash equivalents. It excludes transactions that doesn’t influence cash receipts and payments.

The data on cash flows is helpful in surveying sources of creating and deploying cash and cash equivalents during a period. Also, a cash flow statement can be utilized for correlation with earlier period of the same entity just as comparison with different entities for the same period.

Ind AS 7, Statement of Cash Flows, endorses standards and direction on preparation and presentation of cash flows of an entity from operating activities, investing activities and financing activities for a period.

What is a Cash Flow?

Cash flow statement is a statement, which gives the insights concerning how the cash is generated by an entity during a particular period and how it is applied. At the same time, it mulls over the opening balances of cash and cash equivalents, adds the cash generated, deducts the cash payments and reconciles it with closing balances of cash and cash equivalents. The cash flows are characterized into following three fundamental categories:

- Cash flows from Operating Activities

- Cash flows from Investing Activities

- Cash flows from Financing Activities

What are the objectives of a Cash Flow Statement?

To provide information about historical changes in cash and cash equivalents

Cash flow statement targets giving the data about how the cash has been generated during a period and for what purposes has it been used.

Consequently, data will be provided for the current period and the period immediately prior to it.

To assess the ability to generate cash and cash equivalents

Cash flow statement proposes to give the stakeholders insights about the efficiency of the organization in generating cash and cash equivalents.

A few organizations may look profitable according to profit and loss account yet whether they have sufficient cash for payment of their obligations must be evaluated by utilizing cash flow statement.

To understand the timing and certainty of their generation

What are the benefits of a Cash Flow Statement?

Gives information about liquidity and solvency enabling assessment of changes in net assets and financial structure

Cash flow statement reconciles the opening balances of cash and cash equivalents with the closing balances of cash and cash equivalents, giving the explanations behind the progressions occurred during the year.

Hence, it gives a clear image of cash inflows and outflows that have occurred during the period.

Assesses the capacity to manage cash

The stakeholders find out about what is the source of generation of cash and how it is utilized for. The data gives a reasonable idea regarding the efficiency and capacity of the organization to generate cash.

For instance, assume there is negative cash flow from operations. It signifies that organization can’t generate cash from its principal business activity, which is definitely not a good situation.

Cash flow statements can likewise suggest if an organization could generate adequate cash or not.

For instance, an organization needs to extend its production capacity. The cash flow statement can show whether the organization could generate the necessary cash from their activities, or whether the organization has generated the funds from share capital or whether the organization has taken an advance or loan.

Evaluate the present value of future cash flows

The previous patterns of cash flows will assist the organization to foresee future cash flows.

Such data is helpful while assessing the projects on capital budgeting or valuation of shares.

Hence, it frames the base for future activities and can be discounted utilizing discounting methods.

Compares the efficiency of different organizations

Profits of different entities may have various assumptions, policies and definitions.

Nonetheless, cash flows will be calculated by utilizing the same method.

Consequently, this eliminates all contrasting assumptions across the organizations and an organization can reach to a comparable base of cash and cash equivalents.

In a nutshell...

Each organization, regardless of its size, whether it’s a manufacturing concern or a trading concern or a service provider, needs cash for maintaining its business. The cash is likewise required for future speculations. Cash would be required for mostly everything such as payment of creditors, repayment of loans etc. Accordingly, every organization needs to generate cash and use cash persistently.

Additionally, Banks and Financial organizations are not an exemption. Regardless of whether they manage financial products, accept deposits and issue loans every day, they need to generate cash profit. They need to make investments regarding new branches, set ups and so on.

Hence, cash flow statement is equally significant for every organization irrespective of its size or industry.

RCM on Interest on Late Payment of Imported Goods [Reverse Charge Mechanism (GST)]

The members of Gujarat Authority for Advance Ruling, Goods and Services Tax ruled that the applicant is liable to pay GST on reverse charge mechanism (RCM) for amount paid as interest on late payment of invoices of imported goods at the same rate of IGST leviable on the imported goods vide Advance Ruling No. GUJ/GAAR/R/01/2021 dated 20th January, 2021.

The details of the Advance Ruling are as under:

Brief Facts

- The applicant M/s. Enpay Transformers Components India Ltd. (hereinafter referred to as Enpay, India) is engaged in the business of manufacturing and supplying Transformer components.

- The applicant has stated that the company is importing goods from the holding company located at Turkey namely M/s. Enpay Endstriyel Pzarlama ve Yatirim A.S. (hereinafter referred to as Enpay, Turkey).

- The payment term is 120 days from the date of invoice for import of goods.

- If Enpay, India does not pay Enpay, Turkey on or before due date, the holding company charges interest on late payment.

- The company has obtained bank credit facility from CITI Bank based on the Corporate Guarantee issued by holding company Enpay, Turkey.

- Enpay, Turkey has paid Stamp tax in Turkey as per their land rules and has raised a reimbursement invoice to ENPAY India.

- Enpay, India is importing goods on CIF basis (cost, insurance, freight) and the invoice, raised by the seller, clearly contains the amount of ocean freight.

- It is also noted that at the time of Bill of Entry, the assessable value calculated for payment of IGST includes the value of ocean freight.

- Hence, IGST is already paid on the value of ocean freight at the time of customs clearance.

Questions seeking Advance Ruling

- Whether liability to pay GST on Reverse Charge arises on amount paid as interest on late payment of invoices of imported goods? If yes, then at what rate?

- Whether liability to pay GST on Reverse charge arises on amount paid for reimbursement of Stamp tax paid as a pure agent by Enpay, Turkey on behalf of Enpay, India?

- Whether Entry No.10 of Notification No.10/2017 issued under IGST is applicable, if import of goods is made on CIF (Cost, Insurance, Freight) where the supplier is charging sea/ocean freight in his invoice itself and IGST is already paid at the time of Bill of Entry by including the same value of ocean freight in the assessable value?

Submissions and Additional Submissions by the Applicant

- The applicant has submitted his view of interpretation of law on the above issues stating that the stamp tax is paid by Enpay, Turkey on behalf of Enpay, India for proceedings of Corporate Guarantee/Bank Guarantee and Enpay, Turkey has also raised an invoice for the reimbursement of the same.

- The applicant has stated that the Explanation to Rule 33 of the GST Valuation Rules, 2017 gives following meaning of ‘Pure Agent’:

“Pure Agent” means a person who- enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both;

(a) neither intends to hold nor holds any title to the goods or services or both so procured or supplied as pure agent of the recipient of supply;

(b) does not use for his own interest such goods or services so procured; and

(c) receives only the actual amount incurred to procure such goods or services in addition to the amount received for supply he provides on his own account.

- The applicant has submitted that the Stamp duty is paid by Enpay, Turkey and they neither intends to hold any title for it nor use for their own interest.

- Enpay, Turkey has received only the actual amount of stamp tax paid.

- Considering the above facts, the value paid as a reimbursement to Enpay, Turkey should not be considered as import of services but be considered as a payment made to pure agent. Hence, no IGST on RCM should be liable to pay.

- As regards the import of goods, the applicant has stated that the import of goods is made on CIF (cost, insurance, freight) where the supplier charges sea/ocean freight in his invoice and IGST is paid on the ocean freight at the time of Bill of Entry as the same is included in the assessable value.

- Enpay, India does not directly pay amount of sea/ocean freight to the service provider.

- Considering the above facts and considering that IGST is already paid on imports made on CIF basis, the entry No.10 of Notification No.10/2017 issued under IGST Act should not be made applicable. Hence, no IGST should be paid on it again under Reverse charge.

- The applicant had given additional submission vide letter dated 09.01.2021 (received vide email on 11.01.2021) on being asked to furnish, during hearing, the details of stamp tax paid and clarification regarding whether any markup/profit had been charged by Enpay, Turkey from Enpay, India while making payment of stamp tax on their behalf.

- Accordingly, they submitted copy of a clarification in writing from Enpay, Turkey stating that no mark up (profit) was charged for the reimbursement of stamp tax paid.

- They submitted the table for Stamp Tax Collection as under:

Particulars

Corporate Guareantee Tax

Base Tax (USD)

1,500,000

Exchange Rate (USD/TL)

4.1358

Base Tax (TL)

6,203,700

Tax Rate

0.948%

Stamp Tax Charges (TL)

58,811.08

Stamp Tax Charges (USD)

14,220

- Also, they submitted a receipt of stamp tax issued by the Stamp Tax office for reference along with copy of invoice raised by Enpay, Turkey.

Discussions and Findings

- During the course of personal hearing, the representative of the applicant withdrew the third question of his application seeking Advance Ruling.

- Further, during the course of personal hearing, the representative of the applicant was asked to submit a copy of contract signed between them and Enpay, Turkey in respect to the transactions between them.

- However, no copy of the contract/agreement was submitted by the applicant.

- The members of Authority for Advance Ruling proceeded to decide the issue on the basis of available records.

- On going through the provisions of Section 7 of the CGST Act, 2017, they found as per Section 7(1)(d), the activities to be treated as supply of goods or supply or services are covered in Schedule II of the said Act.

- On going through Schedule II of the said Act, and comparing the same to the issue in hand, they found that the foreign seller had tolerated the act (covered under the Supply of Services under Entry (e) of Schedule-II) of receiving payment after a lapse of a period of 120 days from the date of the invoice in respect of the goods supplied by them to the applicant for which interest is to be paid by the applicant.

- Further, they found that as per Section-15(2)(d), value of supply also includes “interest or late fee or penalty for delayed payment of any consideration for any supply” and concluded that payment of interest by the applicant was liable to GST.

- Additionally, as the interest paid for delay in payment was included as a part of the value of the said goods, the rate of GST payable on the aforementioned interest will be the same as that of the IGST applicable on the aforementioned goods.

- Coming to the second question, They went through the letter dated 09.01.2021 issued by Enpay, Turkey to Enpay, India stating that no mark up (profit) was charged for the reimbursement of stamp tax paid against corporate guarantee issued to CITI Bank as security/collateral for funded/non-funded facility used by Enpay, India.

- Other than that, they found that the applicant submitted certain documents which were in foreign language (perhaps Turkish), which they could not understand.

- Further, since no English translation of the same was made available to them, they were not able to make out whether any of these documents pertain to receipt of stamp tax issued by Stamp Tax Office, Turkey or otherwise, as stated by the applicant.

- The definition of ‘consideration’ clearly includes any payment made or to be made, in respect of supply of goods or services or both by the recipient or by any other person. It also includes the monetary value of any act or forbearance, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person.

- Comparing the aforementioned definition to the issue in hand, they found that in the instant case, the Bank Guarantee entered into by the supplier with the CITI Bank on behalf of the applicant, is in direct relation to the business connection/link that they had with the applicant by way of supply of goods to them and therefore, the payment of stamp tax made by them to the bank (on behalf of the applicant) and demanded by them from the applicant as reimbursement through issuance of a reimbursable invoice would be considered to be payment made in respect of (or in relation to) the supply of goods made by them to the applicant.

- They also went through the provisions of Section 15 of the CGST Act, 2017 mentioned above which covers the aspect of valuation and found that ‘reimbursements’ were not covered in the excluded clauses of value as appearing in sub-section (3) of Section 15.

- Therefore, the amount of stamp tax, which is paid as reimbursement by the applicant undoubtedly formed a part of the ‘consideration’ i.e. the value of the supply of goods provided by the supplier to the applicant and GST is liable on the same.

- However, taking into consideration the provisions of Rule 33 of the CGST Rules, 2017, they found that the amount of stamp tax incurred by the supplier on behalf of the applicant, shall be excluded from the value of supply, if, and only if, the supplier i.e. M/s.Enpay, Turkey satisfied all the conditions envisaged in Rule 33(i) to (iii) as well as the conditions (a) to (d) envisaged in the Explanation to Rule 33 of the CGST Rules, 2017.

- They, therefore, proceeded to examine as to whether the supplier i.e. Enpay, Turkey satisfied all the conditions mentioned hereinabove and satisfied the conditions of a pure agent, which are enlisted hereunder:

(i) the supplier acts as a pure agent of the recipient of the supply, when he makes the payment to the third party on authorisation by such recipient

- No such document, agreement or contract has been produced by the applicant which proves that they have authorised the supplier to make payment to the third party.

- In view of absence/non-submission of any such documents in this regard, they concluded that this condition was not satisfied.

(ii) the payment made by the pure agent on behalf of the recipient of supply has been separately indicated in the invoice issued by the pure agent to the recipient of service;

- In this regard, the applicant themselves submitted that the supplier had issued them a separate invoice mentioning the reimbursable amount therein.

- They also found that the amount of stamp tax paid by the supplier on behalf of the applicant has been mentioned in a separate commercial invoice issued to the applicant.

- However, in the condition mentioned above, there was no mention of issuance of any separate invoice regarding payment made by pure agent.

- As per the said condition, the supplier was required to indicate the aforementioned payment amount (made on behalf of the recipient of supply), separately in the invoice issued by him to the recipient of service/goods i.e. it should form a part of the invoice (related to the supply of goods) issued by the supplier and should be indicated separately, therein.

- The applicant did not submit any evidence to prove that the aforementioned amount paid as stamp tax by the supplier on behalf of the applicant has been indicated separately in the invoice related to the supply of goods made to them.

- Hence, this condition was not satisfied.

(iii) the supplies procured by the pure agent from the third party as a pure agent of the recipient of supply are in addition to the services he supplies on his own account:

- In the instant case, the Bank Guarantee entered into by the supplier with the CITI Bank (the third party) on behalf of the applicant is in direct relation to the business connection/link that they are having with the applicant by way of supply of goods to them and are not in addition to the supply of services/goods that they provide to the applicant on their own account.

- Hence, this condition was also not satisfied.

- Further, as per Explanation to Rule 33 of the CGST Rules, 2017, the following conditions are also needed to be satisfied to qualify as a ‘pure agent’:

(a) enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both;

- No such document, agreement or contract has been produced by the applicant which proves that they have entered into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both.

- Hence, this condition was not satisfied.

(b) neither intends to hold nor holds any title to the goods or services or both so procured or supplied as pure agent of the recipient of supply;

- The applicant submitted that the stamp duty paid by the supplier Enpay, Turkey neither intends to hold any title for it nor uses for his own interest.

- However, they did not provide any documentary evidence to prove that the supplier neither intends to hold nor holds any title to the goods or services or both so procured or supplied as pure agent of the recipient of supply.

- Hence, this condition was not satisfied.

(c) does not use for his own interest such goods or services so procured;

- In the instant case, the services procured by the supplier were used for his own interest only as the Bank Guarantee entered into by them with the CITI Bank on behalf of the applicant was in direct relation to the business connection/link that they were having with the applicant by way of supply of goods to the applicant.

- Hence, this condition was also not satisfied.

(d) receives only the actual amount incurred to procure such goods or services in addition to the amount received for supply, he provides on his own account.:

- The applicant submitted that the supplier Enpay, Turkey received only actual amount of stamp tax paid.

- The applicant submitted a copy of letter dated 09.01.2021 issued by Enpay, Turkey to Enpay, India stating that no mark up(profit) was charged for the reimbursement of stamp tax paid.

- The applicant also stated that they submitted a copy of receipt of the Stamp tax paid by the Stamp Tax Office, Turkey.

- However, since the documents, other than those mentioned above, were in foreign language (perhaps Turkish), which was not understandable to them and since no English translation of the same was made available to them, they were not able to make out whether any of these documents pertained to receipt of stamp tax issued by Stamp Tax Office, Turkey or otherwise.

- They emphasized that a mere letter issued by the supplier stating that no mark up(profit) was charged for the stamp tax paid by them or a receipt from the Stamp Tax Office, Turkey regarding Stamp Tax paid will not suffice to prove that no mark up was charged for the said reimbursement amount, but has to be backed up by proper documentary evidence such as financial records etc. of the supplier.

- Since no such documents was produced by the applicant, they concluded that this condition was also not satisfied.

- In view of the above discussions, they concluded that the supplier of the applicant did not fulfill/satisfy all the conditions required for being a ‘Pure agent’ in terms of the provisions of Rule 33 of the CGST Rules, 2017 and therefore, the expenditure or costs incurred by the supplier of the recipient of supply cannot be excluded from the value of supply in terms of the provisions of Rule 33 of the said rules and is liable to GST on reverse charge basis.

Ruling

- Whether liability to pay GST on Reverse Charge arises on amount paid as interest on late payment of invoices of imported goods? If yes, then at what rate?

The applicant Enpay, India is liable to pay GST on reverse charge basis for amount paid as interest on late payment of invoices of imported goods for the reasons discussed hereinabove. The rate of GST will be the same as the rate of IGST leviable on the imported goods for the reasons discussed hereinabove.

- Whether liability to pay GST on Reverse charge arises on amount paid for reimbursement of Stamp tax paid as a pure agent by Enpay, Turkey on behalf of Enpay, India?

The applicant is liable to pay GST on reverse charge basis on amount paid for reimbursement of Stamp tax paid by the supplier Enpay Turkey on behalf of the applicant, since the supplier of the applicant does not fulfil/satisfy all the conditions required for being a ‘Pure agent’ in terms of the provisions of Rule 33 of the CGST Rules, 2017 for the reasons discussed hereinabove.

Feel free to contact us in case of any clarification required. You can download the entire ruling from here.

Relevant Provisions / References:

Section 7 of the CGST Act, 2017:

7. (1) For the purposes of this Act, the expression “supply” includes––

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

(b) import of services for a consideration whether or not in the course or furtherance of business;

(c) the activities specified in Schedule I, made or agreed to be made without a consideration; and

(d) the activities to be treated as supply of goods or supply of services as referred to in Schedule II.

7. (2) Notwithstanding anything contained in sub-section (1),––

(a) activities or transactions specified in Schedule III; or

(b) such activities or transactions undertaken by the Central Government, a State Government or any local authority in which they are engaged as public authorities, as may be notified by the Government on the recommendations of the Council, shall be treated neither as a supply of goods nor a supply of services.

7. (3) Subject to the provisions of sub-sections (1) and (2), the Government may, on the recommendations of the Council, specify, by notification, the transactions that are to be treated as—

(a) a supply of goods and not as a supply of services; or

(b) a supply of services and not as a supply of goods.

Transfer

(a) any transfer of the title in goods is a supply of goods;

(b) any transfer of right in goods or of undivided share in goods without the transfer of title thereof, is a supply of services;

(c) any transfer of title in goods under an agreement which stipulates that property in goods shall pass at a future date upon payment of full consideration as agreed, is a supply of goods.

Land and Building

(a) any lease, tenancy, easement, licence to occupy land is a supply of services;

(b) any lease or letting out of the building including a commercial, industrial or residential complex for business or commerce, either wholly or partly, is a supply of services.

Treatment or process

Any treatment or process which is applied to another person’s goods is a supply of services.

Transfer of business assets

(a) where goods forming part of the assets of a business are transferred or disposed of by or under the directions of the person carrying on the business so as no longer to form part of those assets, whether or not for a consideration, such transfer or disposal is a supply of goods by the person;

(b) where, by or under the direction of a person carrying on a business, goods held or used for the purposes of the business are put to any private use or are used, or made available to any person for use, for any purpose other than a purpose of the business, whether or not for a consideration, the usage or making available of such goods is a supply of services;

(c) where any person ceases to be a taxable person, any goods forming part of the assets of any business carried on by him shall be deemed to be supplied by him in the course or furtherance of his business immediately before he ceases to be a taxable person, unless—

(i) the business is transferred as a going concern to another person; or

(ii) the business is carried on by a personal representative who is deemed to be a taxable person.

Supply of services

The following shall be treated as supply of services, namely:—

(a) renting of immovable property;

(b) construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly,except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier. Explanation.—For the purposes of this clause—

(1) the expression “competent authority” means the Government or any authority authorised to issue completion certificate under any law for the time being in force and in case of non-requirement of such certificate from such authority, from any of the following, namely:—

(i) an architect registered with the Council of Architecture constituted under the Architects Act, 1972; or

(ii) a chartered engineer registered with the Institution of Engineers (India); or

(iii) a licensed surveyor of the respective local body of the city or town or village or development or planning authority;

(2) the expression “construction” includes additions, alterations, replacements or remodelling of any existing civil structure;

(c) temporary transfer or permitting the use or enjoyment of any intellectual property right;

(d) development, design, programming, customisation, adaptation, upgradation, enhancement, implementation of information technology software;

(e) agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act; and

(f) transfer of the right to use any goods for any purpose (whether or not for a specified period) for cash, deferred payment or other valuable consideration.

Composite supply

The following composite supplies shall be treated as a supply of services, namely:—

(a) works contract as defined in clause (119) of section 2; and

(b) supply, by way of or as part of any service or in any other manner whatsoever,of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service is for cash, deferred payment or other valuable consideration.

Supply of Goods

The following shall be treated as supply of goods, namely:— Supply of goods by any unincorporated association or body of persons to a member thereof for cash, deferred payment or other valuable consideration.

Section 15 of CGST Act, 2017

15. (1) The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

(2) The value of supply shall include–––

(3) The value of the supply shall not include any discount which is given––

(a) before or at the time of the supply if such discount has been duly recorded in the invoice issued in respect of such supply; and (b) after the supply has been effected, if—

(4) Where the value of the supply of goods or services or both cannot be determined under sub-section (1), the same shall be determined in such manner as may be prescribed. (5) Notwithstanding anything contained in sub-section (1) or sub-section (4), the value of such supplies as may be notified by the Government on the recommendations of the Council shall be determined in such manner as may be prescribed. Explanation.—For the purposes of this Act,––

(a) persons shall be deemed to be “related persons” if––

(b) the term “person” also includes legal persons; (c) persons who are associated in the business of one another in that one is the sole agent or sole distributor or sole concessionaire, howsoever described, of the other, shall be deemed to be related.

Rule 33 of CGST Rules, 2017

Value of supply of services in case of pure agent.-Notwithstanding anything contained in the provisions of this Chapter, the expenditure or costs incurred by a supplier as a pure agent of the recipient of supply shall be excluded from the value of supply, if all the following conditions are satisfied, namely,-

Explanation.- For the purposes of this rule, the expression “pure agent” means a person who-

(a) enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both;

(b) neither intends to hold nor holds any title to the goods or services or both so procured or supplied as pure agent of the recipient of supply;

(c) does not use for his own interest such goods or services so procured; and (d) receives only the actual amount incurred to procure such goods or services in addition to the amount received for supply he provides on his own account.

“Consideration” in relation to the supply of goods or services or both includes––

(a) any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government;

(b) the monetary value of any act or forbearance, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government:

11 Ways to Improve Productivity while Working from Home

Work from home has now become a norm now. Sooner or later, everyone will have to accept it as a part of the new normal. Some of us having been doing it from long while some have been forced to because of the pandemic. However, a common concern faced by all working from home is Productivity.

Here are 11 ways to improve productivity while working from home:

1. Dress Yourself as you do for Office

It may seem unnecessary but a formal dress can do wonders to your productivity. Formally dressing yourself evokes a sense of seriousness and discipline. This has a positive psychological impact on your efficiency, seriousness, discipline and productivity.

2. Arrange a Table Chair Setup

Ideally, you would want to arrange an isolated work space at your home. However, if that is not possible, arrange a table chair setup.

Avoid working on sofa or bed at any cost.

3. Create a Distraction Free Environment

Make your family understand that now is the time to work harder. This is not a paid vacation. Hence, you need space during your office hours.

Also, avoid your urge to check notifications, messages and social media.

4. Create a Realistic Schedule and be Punctual

You need to designate your office hours and stick to it. During office hours, create a schedule of work required to be done and ensure achieving your schedule before the end of your designated office hours.

Include breaks, lunch, hydration, snacks etc. in your schedule. Do not let your after office hours become office hours as well.

Additionally, you may make use of some time management and tracking tools or software, if your work demands so.

5. Prefer communicating over Video or Audio than Text

Since, you are not in vicinity with your team members, there are high chances of miscommunication. Hence, prefer speaking your colleagues and clients over video chat or phone call than texting them.

6. Take Breaks not Vacations

Taking small breaks during work is healthy. However, always time your breaks and make them short. User your short breaks productively to stretch, move a bit or to grab a bite or coffee or something.

Having said so, do not take frequent short breaks. It becomes difficult to regain and maintain focus if you take too many frequent breaks.

7. Nothing Personal at Work; No Work after Work

Keep your personal and professional life separate. This cannot be more emphasized while working from home.

While you are working, work as you are in office and keep your personal life separate. Having said so, once you stop working, completely disconnect from your work and focus on your personal life.

Working from home has made the already difficult task of separating personal and professional life, more difficult. However, drawing a boundary helps achieve peace of mind and consequently, boost your productivity.

8. Create an Environment of Positive Vibes

Maintain a surrounding of things which boosts your positivity. Have around you, green plants, uplifting posters, soothing colors, mild music or anything of your personal preference, which boosts your positivity and improves the environment.

9. Have a Target-Oriented Approach

Challenge yourself with targets. Create and achieve realistic targets, challenge yourself, push yourself harder. Strive to be better and better with each passing moment.

10. Use Collaborative and Remote Working Tools

Familiarize and upgrade yourself with Technology. Use collaborative and remote working technologies to synchronize with your team and achieve results with optimum efficiency.

11. Have Better Internet Speed and Connectivity

Internet is a must for working remotely. It is highly frustrating when slow internet bogs you down. Hence, invest in a good internet connection.

What would be your #12? Let me know in the comments below.

5 Benefits of Outsourcing Book-Keeping

A business, irrespective of its size, has multiple departments. Further, many businesses, startups and entrepreneurs find it challenging to manage their account departments and cope with their regular book-keeping needs.

It doesn’t take long for a new entrepreneur to understand that accurate and up-to-date financial records play an important role in the success of a business. However, the daily tasks required to maintain these records often fall to the bottom of an entrepreneur’s to-do list.

Hiring and managing an accountant is a tedious, time-consuming and an expensive process. Above all, it has become more and more difficult to find a qualified accountant and eligible person at an affordable rate. However, there is a simpler solution to this problem – Outsourcing Book-keeping. Here are 5 reasons why outsourcing book-keeping is beneficial for your business:

Reduces Cost upto 80%

Outsourcing book-keeping means not only reducing cost considerably but also improving quality. Consequently, book-keeping can be outsourced to skilled professionals at highly affordable rates which is very low compared to hiring an inhouse accountant. Firstly, recurring cost of an inhouse accountant is costly to maintain. Secondly, not every entrepreneur can afford the luxury of an accountant. Thirdly, and the most importantly, the cost of training and managing an inhouse accountant is huge. In conclusion, outsourcing book-keeping is a multi-faceted means of saving cost.

“If you would be wealthy, think of saving as well as getting.” — Benjamin Franklin

Saves Time

As you grow your business, you will feel the need to spend more time in expanding your business than managing your books. Hence, outsourcing administrative tasks like book-keeping helps you focus your time, energy and resources on sales, networking, marketing and other revenue driven departments.

"The bad news is time flies. The good news is you're the pilot." — Michael Altshuler

Professional Expertise

We have already understood that outsourcing administrative tasks such as book-keeping reduces your costs and saves time. However, along with such benefits, the quality of the services received is increased significantly. Outsourcing your book-keeping to professionals will ensure accuracy and completeness. Along, with the correctness of your accounts, you will not have to worry about the lapses in various technical and legal compliance required by various statutory bodies. In short, You get your financials tax and audit ready.

“I hire people brighter than me and then I get out of their way” — Lee Lacocca, Ford

Easy Scaling of Resources

As you grow your business, you might require to deploy additional resources to manage your administrative tasks. Extra workforce is readily available with professionals who undertake outsourcing. This gives you the flexibility of scaling your resources without going through the rigorous hassles of hiring, monitoring, maintaining and training.

“Growth is never by mere chance; it is the result of forces working together.” — James Cash Penney

Remaining updated with Technology

Professionals these days use cloud based softwares which are extremely secure and robust. Consequently, most of the professionals remain updated with the updates in technology in accounting and book-keeping. The use of these softwares have ensured readiness and availability at the click of a button. Hence, your books of accounts are readily available for you to view and monitor. This way, you are not oblivious of your financial status and are always ready with updated numbers, as and when required.

“It’s not that we use technology, we live technology.” — Godfrey Reggio

Whether a business needs current financial figures to present to a banker or to just keep tabs on cash flow, keeping up to date on accounting tasks is essential.

There are significant advantages for clients who decide to outsource their accounting tasks. To begin with, cost-efficiency and having flexibility of contracts or scaling of functions are just the tip of the iceberg.

Accounting and bookkeeping are a vital part of business, but also complex. Likewise, it requires time and expert knowledge. Without accounting experience, many errors are bound to occur, potentially, leading to a decrease in your business.

Rekhani and Saraogi, Chartered Accountants, is a leading accountancy, audit and consultancy firm in India with a large team of skilled accountants supervised by our team of experts. We cater many large and small organizations, ranging from established companies to a home based single person start-up, in various sectors. Backed up by experience, skill and vision, we are committed to provide best services to our client and we make sure our commitment leads to your satisfaction.

Interested in finding out more about how you can outsource your bookkeeping? Contact us for more information!

“If you deprive yourself of outsourcing and your competitors do not, you’re putting yourself out of business.” — Lee Kuan Yew, Former Prime Minister of Singapore

“The important thing about outsourcing or global sourcing is that it becomes a very powerful tool to leverage talent, improve productivity and reduce work cycles.” — Azim Premji, Chairman of Wipro Limited

All you need to know about Tax Collected at Source (TCS) u/s 206C(1H) of the Income Tax Act, 1961

A lot of our clients have asked us doubts / queries pertaining to TCS u/s 206C(1H) which has been made effective from 1st October, 2020.

We have prepared a short video on the basis of our knowledge and the queries received comprising of certain Frequently Asked Questions (FAQs).

We hope that the video is helpful and we are able to solve all your queries.

Please note that the video is entirely for educational / academic purpose. This should not be constituted as legal or professional advice. No legal action should be taken on the basis of this video.

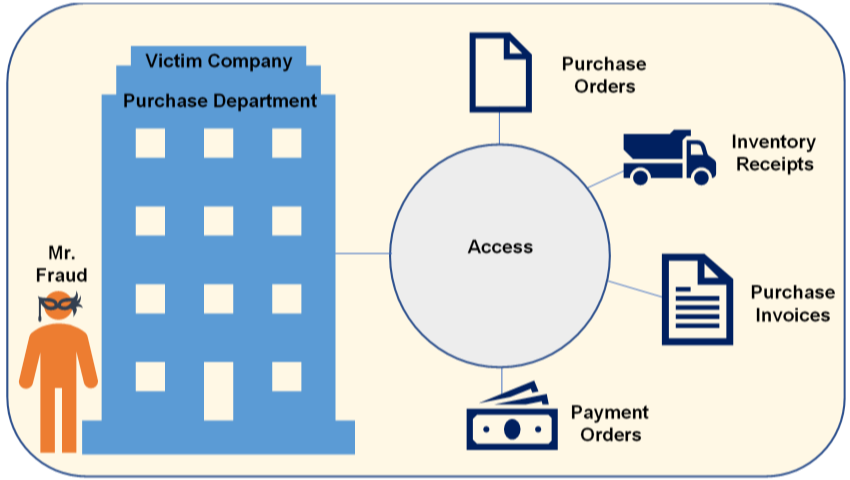

Why Digitization, Risk Assessment and IT Audit?

Background

Earlier, computers were merely used for storing records. But now, they have become a backbone of the decision-making process of a business. We know that the use of technology has made business more efficient. Yet, we cannot undermine the fact that the associated risks have also evolved with the evolution of technology. This emphasizes the need to implement internal controls in the IT infrastructure of business to avoid/mitigate/reduce/accept risks. Normally, people focus on human-prone manual risks. But they tend to ignore the IT infrastructure level risks, some of which even a person with limited knowledge can exploit.

This article discusses wide array of subjects including some practical scenarios of fraud in an IT infrastructure, influence of COVID-19 towards digitization, importance of risk assessment and IT System’s Audit. The language of the article is kept simple for general audience to relate and understand.

Scenarios

Let us assume different scenarios wherein a fraudster, say Mr. Fraud, could try and circumvent the IT infrastructure. We will also discuss a potential solution that an entity could implement to counter Mr. Fraud’s notorious intentions.

Assume Mr. Fraud has recently joined the purchase department of Victim Company. He, out of his old die-hard habits, decides to fiddles around with the existing IT controls.

#

Attempts

Potential Solutions

1

Mr. Fraud realises that he is able to access the vendor master. Also, he is able to create and modify records in the vendor master. Mr. Fraud creates a fictitious vendor ‘The Fraud Enterprises’ in the system.

Restrict access of vendor master to authorized personnel only.

Segregate duties of people based on access to create/modify a vendor.

Additionally, implement a maker-checker control whereby another person has to approve the vendor. A maker-checker control is a control where a different person has to approve a transaction performed by one person to process.

2

Let’s assume a case where Mr. Fraud could not create a vendor but was able to create a purchase order for ‘The Fraud Enterprises’. The system allowed creating purchase orders for suppliers not defined in the vendor master.

Restrict purchases, receipts and invoices to suppliers defined in the vendor master and for goods and services defined in the item master.

Additionally, restrict creating/modifying purchase orders for value of goods and services above the rates defined in the item master.

3

Mr. Fraud makes an under the table deal with a supplier – Mr. Opportunist and creates a fictitious purchase order in his name.

Restrict access of transactions to create/modify purchase orders to authorized personnel only.

4

Mr. Fraud performs a fictitious inventory receipt from Mr. Opportunist.

Map Goods Receipt transactions with open Purchase Orders to restrict over-receipt of goods.

Segregate duties of people who have access to create/modify Purchase Orders and people who have access to create/modify Inventory Receipts.

Define an upper tolerance limit for restricting receipt of goods above a certain level from the quantity mentioned in the respective purchase order.

5

Mr. Fraud books a fictitious purchase invoice from Mr. Opportunist.

Map Purchase Invoice transactions with un-booked goods receipts and open Purchase Orders to restrict over invoicing at quantity and amount level.

Segregate duties of people who have access to create/modify Purchase Orders, people who have access to create/modify Inventory Receipts and people who have access to create/modify Invoices.

6

Mr. Fraud books a fictitious purchase invoice from Mr. Opportunist and makes a payment order.

Restrict access of payment orders to authorized personnel only.

Segregate duties of people with access to create/modify invoice and people with access to create/modify payment orders.

Additionally, implement a maker-checker control where another person has to approve the payment order.

The above instances are simply illustrative and the scope of the fraud and controls are extremely broad. We have just seen the tip of the giant iceberg hidden underneath the sea.

The controls discussed in the above illustrations are known as application controls. It includes completeness and validity checks, identification, authentication, authorization, input controls, and forensic controls, among others.

Impact of COVID-19 pandemic

The situation created by the COVID-19 pandemic has been an eye-opener for many business entities. And, by now, they must have realized the importance of digitization. It is time for people who were averse of technology to embrace it but with caution. A strong IT Infrastructure is definitely a roadmap to a very successful future. A question which everyone should ponder is – What is your strategy during the crisis, right after the crisis and for the new normal?

Need of the hour

Embracing new technology is the roadmap to transform business models, drive growth and improve efficiency. The business processes and controls, though efficient and effective today, may be completely obsolete tomorrow.

Yet, we must also realize the risks which come along with digitization, as discussed earlier. But, one can avoid many risks simply by implementing commonly known best-practices. To survive and thrive, learning from the past while looking at the future should form the base of risk management. The risk assessment should include all categories of risk and should be enterprise-wide. Additionally, in light of the face past change of technology, one must update the controls regularly as well.

Conclusion

It has become incumbent for business to ensure security of their IT infrastructures and ensure the confidentiality, integrity and availability of the application and its associated data.

This has increased the importance of IT System’s Audit. The role of an IT auditor is unknown to most but it impacts the lives of all. It adds security, reliability and accuracy to the IT infrastructure of the business. The role of an IT auditor is extremely dynamic which includes identifying the weakness in the IT infrastructure and creating an action plans to prevent the threats before they materialize.

The need for audit of Information Systems can be highlighted as under:

- High Cost of Incorrect Decision Making: Management and operational controls taken by managers involve detection, investigations and correction of the processes. An independent third-party review can ensure accurate data to make quality decisions.

- High Cost of Computer Error: In a computerized enterprise environment where many critical business processes are performed through the use of systems, an error in data has a huge potential of disruption.

- High Cost of Uncontrolled Evolution of Technology: Use of technology and reliability of complex computer systems cannot be guaranteed and the consequences of using unreliable systems can be destructive.

- High Cost of Technology Abuse: Unauthorized access to systems, unauthorized physical access to facilities and unauthorized copies of sensitive data can lead to destruction of assets (hardware, software, data, information etc.).

The key benefits of IT Audit can be classified as under:

- Enhanced security of data: It provides the business an opportunity to improve or strengthen poorly designed or ineffective controls.

- Reduced IT Related Risks: It reduces, if not mitigates, the risks of confidentiality, integrity and availability of IT processes and data due to timely assessment.

- Enhanced IT Governance: Compliance with Laws and regulations by the business and its stakeholders should be inherently built in the IT infrastructure. It provides a business an evaluation of how much is it synchronized with law.

Conducting a risk assessment more frequently, ideally on a continuous basis, will go a long way to avoid, reduce or mitigate risks. An IT Auditor can bring the required subject-matter knowledge and business insights to provide an objective assessment of the current state and offer guidance on developing an efficient and effective internal process.

To prepare for tomorrow is not something which can be done overnight but is a journey. Digitization, or should we say Machine over Man, is likely going to be the new normal. Are we ready?

Let’s connect to discuss more.

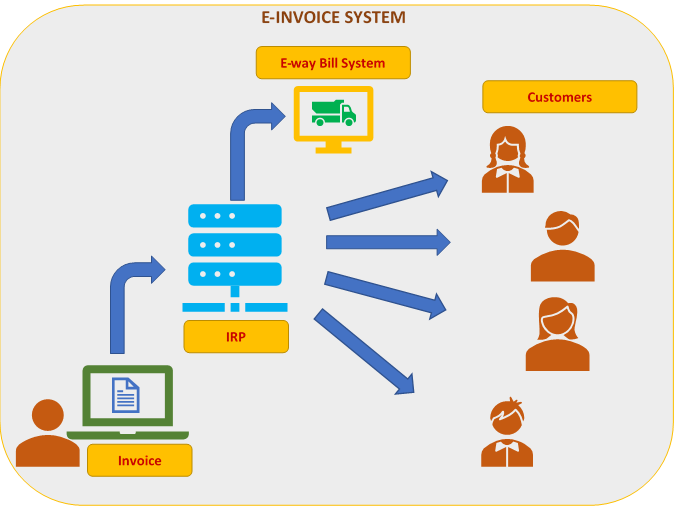

E-Invoice Eco-System of India: A perspective of the Ideal World Scenario

Introduction

The GST council approved introduction of E-invoice System in a phased manner for business to business (B2B) invoices from 1st January, 2020 on voluntary basis. As of now, the mandatory requirement for E-invoicing for registered persons whose aggregate turnover in a financial year exceeds INR 100 crores shall now apply from 01st October, 2020 vide Notification No. 13/2020– Central Tax dated 23rd March, 2020. Also, the requirement for capturing dynamic QR code for registered persons whose aggregate turnover in a financial year exceeds INR 500 crores while making supplies to unregistered persons shall now apply from 01st October, 2020 vide Notification No. 14/2020– Central Tax dated 23rd March, 2020.

However, there are many confusions prevailing over this topic and many words have become simply jargons. I aim to simplify the understanding of e-invoice in layman terms. This will enable the readers to understand how the system works and what will happen if you choose to adopt it.

What is E-invoice?

There are many confusions/queries with respect to the operations of E-invoice System. Many are of the belief that E-invoicing will eliminate the use of their accounting softwares / ERP. Let us put all such notions to rest.

In simple terms, E-invoice means a standard set of fields which is uploaded on Invoice Registration Portal (IRP). The details which are available on a regular invoice will be uploaded to IRP. The process is very similar to data being uploaded for filing of GSTR 1.

However, there is a slight difference. In this system, a method has been introduced where an invoice is converted into a data with a common standard which can be read by anyone in the GST ecosystem.

The IRP will validate the data uploaded by the user and on successful validation, will generate a unique Invoice Registration Number (IRN) / Hash. The IRN will be generated by a hashing algorithm which will always remain unique for each invoice. Alternatively, the IRN can be generated by the accounting software/ERP using the hashing algorithm. The invoice will be digitally signed and a QR code for the same will be generated with the following parameters:

- GSTIN of the supplier

- GSTIN of the Recipient

- Invoice number as given by Supplier

- Date of invoice

- Invoice value

- Number of line items

- HSN code of the line item having highest taxable value

- Unique IRN / Hash

This will enable the invoice to be read by any handheld or other device with the functionality of reading QR codes.

What is IRN?

IRN is generated by the E-invoice system using a hash generation algorithm. For every document submitted on the E-invoice System, a unique 64 character IRN shall be generated. This will be unique for each invoice.

How does it impact the common user of the accounting software / ERP?

It does not at all. The invoices generated by you will remain same. The procedure would be performed by the accounting software / ERP probably in the background where the software will upload the details of the invoice to the IRP in scheduled batches.

World-wide implementation of E-invoicing (2018)

E-invoicing for B2B transactions is mandatory in the following countries:

- Belarus

- Brazil

- Chile

- Costa Rico

- Indonesia

- Mongolia

- Rwanda

- Turkey

- Ukraine

- Uruguay

Though E-invoicing is not mandatory but is allowed in the following countries:

- Albania

- Angola

- Australia

- Austria

- Belgium

- Botswana

- Bulgaria

- China (mainland)

- Croatia

- Curacao

- Cyprus

- Czech Republic

- Denmark

- El Salvador

- Estonia

- Finland

- France

- Germany

- Guam

- Hong Kong

- Iceland

- Ireland

- Isle of Man

- Israel

- Italy

- Kazakhstan

- Korea

- Latvia

- Lithuania

- Luxembourg

- Macedonia

- Malta

- Moldova

- Namibia

- Netherlands

- New Zealand

- Norway

- Pakistan

- Papua New Guinea

- Philippines

- Poland

- Portugal

- Romania

- Russia

- Senegal

- Serbia

- Singapore

- Slovakia

- Slovenia

- South Africa

- Spain

- Sri Lanka

- Sweden

- Switzerland

- Taiwan

- Uganda

- United Kingdom

- Vietnam

This signifies that India has decided to take a leap and be in line with global methodologies. However, we must understand that not many countries have made E-invoicing compulsory.

An implication can be drawn from this that challenges are also being faced by more developed countries than ours. Another drawn implication would be that the countries do not feel the need to do so. Whatsoever the case may be, we cannot ignore the benefits and challenges in adopting e-invoicing.

Why should we adopt E-invoicing?

- Since the outward supplies will be uploaded by the accounting software/ERP regularly and automatically, the time and effort of filing monthly / quarterly returns will be reduced considerably.

- Since the suppliers upload their invoices regularly, the reconciliation process will be seamless or near-seamless. The data of the suppliers can be downloaded by the accounting software/ERP as and when they are uploaded and the entries pertaining to the inward supplies can be entered automatically on the basis of certain pre-defined set of rules.

- One standard structure of the invoice will be followed throughout.

- Regular reconciliation will reduce the possibilities of fake invoices.

- E-invoicing will reduce printing of papers making it an eco-friendly measure.

- Near real-time availability of information will ensure better accounting.

- Automatic data will be transferred to the E-way bill system which will reduce time and effort.

- Manual errors will be reduced if data is uploaded automatically by the system.

Along with the benefits provided to users, this will also strengthen the detective controls adopted by the GST departments where they will be able to detect fraudsters on the basis of irregular patterns.

Challenges in implementing E-invoicing

India is still developing and technology is yet to reach the masses. There are many businessmen in the MSME sector who are still generating invoices manually using invoice books. They provide the copy of the invoices to their tax consultants or tax return preparers for filing GST returns. Not everyone is equipped with the requisite infrastructure.

The E-invoice system cannot function to its full strength until and unless all the tax payers become part of the system.

Additionally, many accounting softwares/ERPs do not follow the standard system development life cycle (SDLC) and are prone to bugs. If the system improperly integrated and the exceptions are poorly handled, there exists likelihood of information not being completely uploaded to IRP. This will compromise the availability aspect and can prove a hurdle in successful implementation.

The invoices might not be synchronized during downtime of IRP, if any. Though, duplication of invoices have been controlled by the use of IRN/hash, there always remains the possibility of invoices being skipped for upload due to any error or incorrect behaviour of the accounting software/ERP or the IRP.

Also, with every structural update by the IRP team, the users will be required to update their accounting softwares/ERPs in order to be in sync with the E-invoice system. The users will have to ensure that they receive constant support from the accounting software/ERP provider.

Are we ready?

The GST council has implemented E-way bill in a phased manner. Speaking about readiness, we will never be completely ready considering the dynamics of India. Radical decisions will have to be implemented in a structured, systematic and phased manner.

During any implementation phase, resistance is always felt. It will be very important for the GST council to implement it in a manner that does not excessively impact the dynamics of business in the country but also does not excessively delay the implementation.

It is very important for the taxpayers to welcome the benefits of the system with open hands despite facing hurdles during the implementation phase. Keeping long term benefit in mind, the taxpayers should prepare, update and change with the system.

The law is definitely moving very fast. It’s time for the people to keep up with the pace and move along.

However, I would also like to emphasize that along with the tax payers, the authorities should also be provided apt infrastructure in order to retrieve the necessary data on demand. This will ensure minimum interactions between the authorities and tax payers and will not create further hurdles in the process.

The Ideal World Scenario

Let us assume a scenario where everyone has adopted E-invoicing and it is being used on near real-time basis. This scenario will enable:

- Near real-time automatic verification of accounts between suppliers and customers.

- Issuing fake invoices will be reduced considerably.

- The origin of the accounts can be tracked along with the chain of invoices.

- The business can set pre-conditions where automatic entry of inward supply transactions can be triggered on meeting of certain conditions.

- The cost and efforts of compliance will be significantly reduced.

- The speed and efficiency will be increased significantly along with significant decrease in manual human errors.

Have suggestions or feedback? Let’s connect to discuss more!